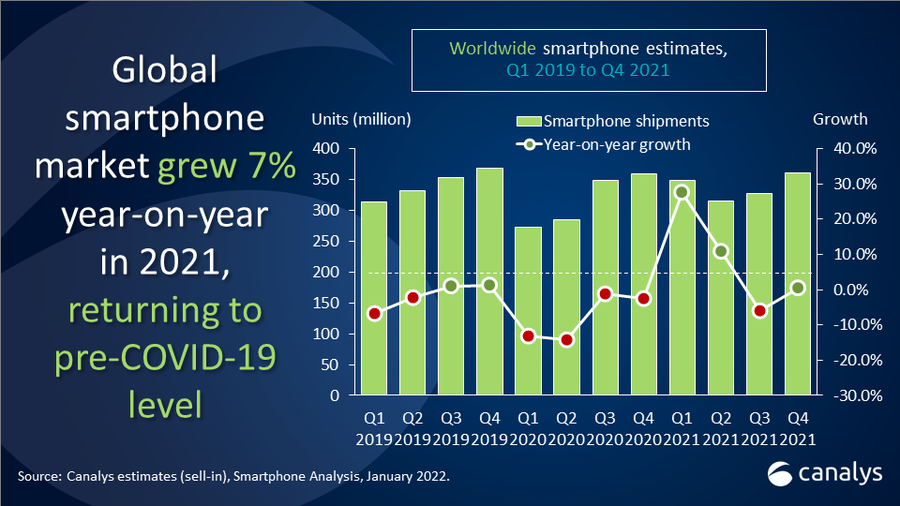

After a turbulent period marked by supply chain issues and economic uncertainty, the global smartphone market bounced back in 2021, shipping 1.35 billion units for the year. This marked a 7% growth year-on-year, bringing shipments close to the pre-pandemic levels of 2019. In Q4 2021, the market grew by 1% year-on-year, with 363 million units shipped, driven by strong performances from key players like Apple and Samsung.

Market Highlights and Vendor Performance

Apple: A Record-Breaking Year

Apple dominated the high-end smartphone segment, shipping 230 million units in 2021, an 11% year-on-year growth. The iPhone 13 series, with its enhanced battery life, ProMotion displays, and Cinematic mode for video, contributed significantly to Apple’s record-breaking holiday quarter. Canalys VP of Mobility, Nicole Peng, commented, “Apple’s success is no surprise, as it continues to attract loyal customers with a robust ecosystem and innovative features.”

Samsung: Steady Growth Amid Challenges

Samsung remained the global leader for the full year, shipping 274.5 million units and holding a 20% market share. The Galaxy A-series played a crucial role in maintaining its dominance, despite supply shortages impacting production. Samsung’s foldable smartphones, including the Galaxy Z Flip3 and Z Fold3, met expectations, shipping eight million units and tripling the previous year’s numbers. As Canalys Research Analyst Le Xuan Chiew noted, “Samsung focused on driving profitability through its high-end portfolio, positioning itself strongly for the coming year.”

Xiaomi, Oppo, and Vivo: Expanding Global Reach

Chinese vendors Xiaomi, Oppo, and Vivo made significant gains in 2021, with Xiaomi shipping 191.2 million units, achieving a remarkable 28% growth year-on-year. Oppo and Vivo followed closely, growing by 22% and 15%, respectively. These brands excelled in emerging markets, leveraging affordable 5G-enabled devices and expanding their product portfolios.

The Impact of Supply Chain Challenges

Supply shortages, particularly in low-end 4G chipsets, remained a major hurdle in 2021. Canalys Analyst Sanyam Chaurasia highlighted the industry’s resilience, stating, “Many vendors delivered their best performances despite component shortages, demonstrating adaptability and strategic planning.” The supply imbalance is expected to ease in 2022, with falling 5G chipset prices driving the next wave of smartphone growth.

Smartphone Releases in 2021

Premium Smartphones:

- Samsung Galaxy S21 Ultra ($1,849): Exynos 2100 / Snapdragon 888, 12GB/16GB RAM, 6.8-inch Dynamic AMOLED 2X display, 120Hz adaptive refresh rate, Quad rear cameras (108MP wide, 10MP telephoto, 10MP periscope telephoto, 12MP ultrawide), 40MP front camera, S Pen support, 100x Space Zoom, 8K video recording.

- Apple iPhone 13 Pro ($1,699): Apple A15 Bionic chip, 6GB RAM, 6.1-inch Super Retina XDR display with ProMotion (120Hz adaptive refresh rate), Triple 12MP rear cameras (wide, telephoto, ultrawide), 12MP TrueDepth front camera, Cinematic mode for video recording, improved battery life.

- Apple iPhone 13 Pro Max ($1,849): Apple A15 Bionic chip, 6GB RAM, 6.7-inch Super Retina XDR display with ProMotion (120Hz adaptive refresh rate), Triple 12MP rear cameras (wide, telephoto, ultrawide), 12MP TrueDepth front camera, Cinematic mode for video recording, improved battery life.

- Google Pixel 6 Pro ($1,299): Google Tensor G1, 12GB RAM, 6.7-inch LTPO OLED display, 120Hz adaptive refresh rate, Triple rear cameras (50MP wide, 48MP telephoto with 4x optical zoom, 12MP ultrawide), 11.1MP front camera, Magic Eraser, Real Tone, improved Google Assistant.

- OPPO Find X3 Pro ($1,699): Qualcomm Snapdragon 888, 12GB RAM, 6.7-inch LTPO AMOLED display, 120Hz adaptive refresh rate, Quad rear cameras (50MP wide, 50MP ultrawide, 13MP telephoto, 3MP microlens), 32MP front camera, Microscopic camera, fast charging, sleek design.

Mid-Range Smartphones:

- Samsung Galaxy A52s 5G ($699): Qualcomm Snapdragon 778G 5G, 6GB/8GB RAM, 6.5-inch Super AMOLED display, 120Hz refresh rate, Quad 64MP/12MP/5MP/5MP rear cameras, 32MP front camera, OIS on main camera, IP67 water resistance.

- Xiaomi 11T ($799): MediaTek Dimensity 1200-Ultra, 8GB RAM, 6.67-inch AMOLED display, 120Hz refresh rate, Triple 108MP/8MP/5MP rear cameras, 16MP front camera, 120W HyperCharge, Dolby Vision Atmos.

- OPPO Reno6 5G ($799): MediaTek Dimensity 900 5G, 8GB RAM, 6.4-inch AMOLED display, 90Hz refresh rate, Triple 64MP/8MP/2MP rear cameras, 32MP front camera, Bokeh Flare Portrait Video, AI Highlight Video.

Budget Smartphones:

- Nokia G10 ($249): MediaTek Helio G25, 3GB/4GB RAM, 6.5-inch IPS LCD, Triple 13MP/2MP/2MP rear cameras, 8MP front camera, Long battery life, affordable price.

- Samsung Galaxy A12 ($299): MediaTek Helio P35, 3GB/4GB/6GB RAM, 6.5-inch PLS IPS LCD, Quad 48MP/5MP/2MP/2MP rear cameras, 8MP front camera, Large battery, side-mounted fingerprint sensor.

- Realme C21Y ($199): Unisoc T610, 4GB RAM, 6.5-inch IPS LCD, Triple 13MP/2MP/2MP rear cameras, 5MP front camera, Large battery, affordable price.

The Road Ahead for 2022

The global smartphone market’s return to pre-pandemic levels in 2021 reflects its resilience and adaptability. As supply constraints gradually ease, the focus will shift to 5G devices as the key growth driver. With leading vendors like Apple, Samsung, and Xiaomi pushing the boundaries of innovation, 2022 promises to be another exciting year for smartphone enthusiasts in Australia and beyond.